Russia And Ukraine: What It Means (And Doesn't) For Your Portfolio

Summary

Tensions are increasing between Russia and Ukraine as the pullback deepens for stocks.

Ultimately stock prices are a function of earnings and valuations (P/E multiples).

If similar conflicts in the past are any guide, the effects on the profits of US companies is likely to be small.

Changes in corporate profits ultimately drive the overwhelming majority of returns.

Stocks are in trouble for different reasons (mainly inflation and unrealistic earnings expectations). But the conflict in Ukraine, in all likelihood, will not be what knocks the stock market down.

Markets were closed Monday of this week as Americans celebrated George Washington's Birthday, colloquially known as President's Day. Also on Monday, Russian President Vladimir Putin ordered Russian troops into the Donbas region of Eastern Ukraine, rattling stock futures. This is a divisive political issue, and there's a range of opinions on what the role of the United States should be in this. In George Washington's famed Farewell Address, he issued a couple of warnings. The first was to not involve the United States in entangling alliances (particularly in Europe), and the second was to avoid forming political parties. His successors took his advice on the former until the founding of NATO in the 1940s but certainly failed to heed the latter warning on the divisiveness of political parties. Because Ukraine is not a NATO member, the United States won't directly be involved.

And despite being the center of attention in the news, war in Ukraine is not likely to have a big impact on the earnings, buybacks, or dividends of the vast majority of companies in your portfolio.

Note that the purpose of this article is to discuss the investment implications–there are human implications as well and we at Seeking Alpha sincerely wish for the safety of any of our readers, friends, or family who are in areas of conflict.

How Stocks Are Valued

Stocks are valued on earnings and their price-to-earnings ratio. For example, the S&P 500 is expected to earn $225 for 2022 and trades for $4325 as of my writing this. If you think this number is solid, that's good for a forward price-to-earnings multiple of 19.2x. Over the past 30 years, the S&P 500 has traded for as high as 25x forward earnings estimates (1999-2000) and as low as 10x forward earnings (in the early 1990s and 2009-2011). Earnings multiples are probably a little higher than they should be, but that can be corrected by the market trading sideways for a year or two while earnings grow. There are a lot of factors that go into what people are willing to pay for stocks, but an important factor in valuations is uncertainty. Another word for uncertainty is fear. Thus, stock valuations are coming down a bit because of fear of a broader conflict. This is normal, and I would expect when the conflict is resolved that buyers will step right back in. A recent paper I read by Bridgewater argues that corrections (10%-20% drops in stock prices) are generally due to changes in multiples, while bear markets (20% or more) are caused by changes in earnings. Whether we'll stay in correction or develop into a bear market isn't set in stone, but what will likely drive it is the level of earnings going forward.

Because Ukraine has such a small economy, this conflict is likely to have little to no impact on the earnings of US companies. I similarly would expect little impact on European earnings either. If you run a quick search in Google Maps, you'll see that Kyiv is a 15-hour drive south and east from Checkpoint Charlie– the previous epicenter of the Cold War. In turn, from Kyiv, it's another 10-hours driving to Mariupol, in the Donbas region. The conflict is a very long way from key manufacturing centers in Europe. Also, Europe doesn't really have the option to stop buying Russian natural gas, minimizing the amount of economic warfare that is likely to occur.

Key points here:

Stock valuations have been affected by the conflict, but valuations aren't super out-of-line historically (outside of large-cap tech and weird speculative pockets like electric car stocks).

Corporate profits are not likely to be affected much by the conflict, but for domestic reasons that have nothing to do with Ukraine, 2022 and 2023 profits are where the trouble is for stocks–it could very well be that 2021's record corporate profits were just a one-time gimmick from stimulus. Earnings estimates are just starting to nudge downward. The recent move in stocks may have a lot more to do with this and a lot less to do with politics than is currently realized. I wrote about this here and here.

Stocks have an earnings problem here, but I hope you can see that the corporate profits of companies like Apple (AAPL) or Microsoft (MSFT) aren't likely to be affected by what happens in Ukraine or Russia. I don't think mega-cap tech is the place to be, but nothing that happens politically should dissuade you from investing in companies you like.

Domestic issues like the health of the U.S. consumer and inflation are going to be much more important in determining which way stocks go over the next 6-12 months.

Past as Prologue

One way to think about the conflict in Ukraine is to compare it with other wars and see how stocks did then.

Seeking Alpha author Wolf Report recently did an article analyzing recent conflicts and their effects on markets, which you can read if you like.

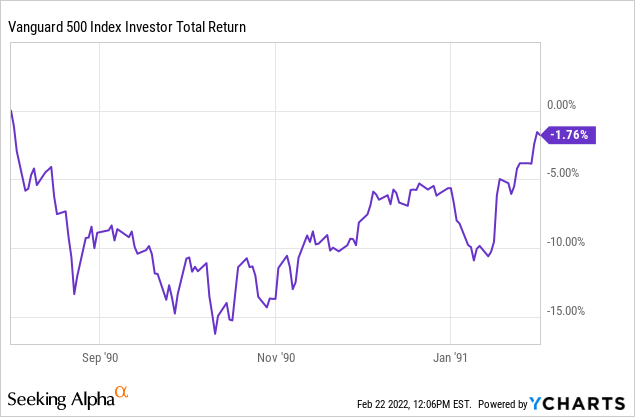

Arguably, the worst stock performance from a conflict in the last 30 years came from the Gulf War in the early 1990s. Stocks drew down about 15% if you count dividends, but recovered within the next year. You should know that there were a lot of other things going on that drove the market down as well though–the US economy was weak in the early 1990s, the asset bubble in Japan was rapidly deflating, and the H.W. Bush administration raised payroll and income taxes in November 1990.

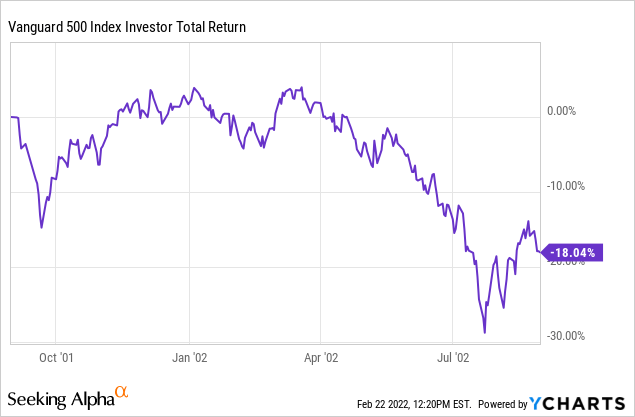

9/11 arguably harmed the US economy more, but the market recovered and was higher a month after before rolling over again as the tech bubble continued to deflate and high-profile corporate frauds were uncovered one by one.

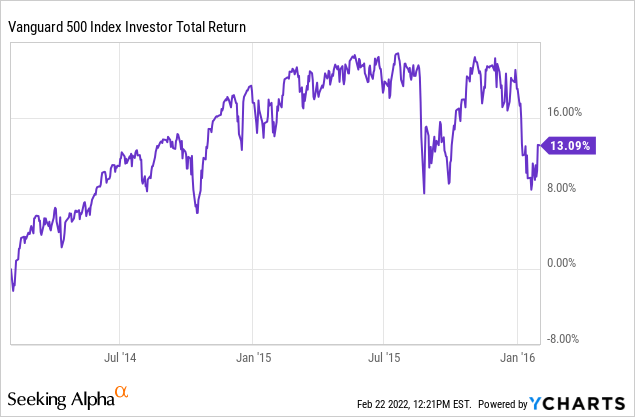

The last time Russia invaded Ukraine in 2014, the stock market shrugged it off.

The past shows that these kinds of geopolitical events don't have much of a long-term effect on markets. While there are reasons to be quite cautious on stocks, I don't think Ukraine and Russia are the main problem with stocks at the moment.

Investment Ideas

The past has shown that the proper response to the Ukraine crisis for long-term investors is likely to be to do nothing and stay the course.

If you want to take action to protect your portfolio from the threat of broader conflict, there are some simple ways to go about it.

Oil: I covered my favorite oil stocks for 2022 last month. They still have room to run, but a lot of the meat is now off the bone. I'd venture a guess that oil has another 6-12 months before it peaks.

Aerospace and Defense: Dr. Michael Burry always has interesting 13-F filings, in the last two quarters he's disclosed positions in Lockheed Martin (LMT) and General Dynamics (GD).

Burry also likes Bristol Myers (BMY), which isn't a defense contractor but was very cheap. Now after running up it's still a little undervalued.

If you're brave, Russian assets have crashed and are generationally cheap. I recognize that this trade isn't for everyone and that there's a significant amount of political risk, but Sberbank (OTCPK:SBRCY), Gazprom (OTCPK:OGZPY), Gazprom Neft (OTCPK:GZPFY), and Lukoil (OTCPK:LUKOY) are all priced to more than double if anything less than the worst-case scenarios in Ukraine are realized, and sport dividend yields at or near double digits.

Bottom Line

Investors tend to fear geopolitical outcomes, but worst-case scenarios are rarely realized. I could be wrong about this, but I firmly believe the world is slowly becoming a more prosperous and peaceful place, and that the simmering conflict in Ukraine will likely be looked back on a couple of years from now as a hiccup as far as stocks are concerned. The main problem for the financial markets is that stocks may have problems hitting earnings estimates that are unrealistically high while inflation erodes consumer spending. That's a domestic issue that's unlikely to be significantly helped or hurt by the Ukraine conflict. By focusing more on earnings and less on geopolitics, investors can get a clearer picture of what stocks are likely to do and position accordingly.

This article was written by Logan Kane

Author, entrepreneur and Texan. My articles typically cover portfolio strategy, value investing, and behavioral finance. I like to profit from the biases and constraints of other investors.

Jewish Corruption in Ukraine . . . by Andrew Joyce, Ph.D.

❝. . . the present conflict is a huge distraction from the fact that, for decades, the biggest threat to Ukraine hasn’t been Russia, but financiers and speculators operating with impunity within Ukraine’s borders to exploit ethnic Ukrainians and plunder their resources.❞

https://www.theoccidentalobserver.net/2023/02/17/jewish-corruption-in-ukraine/