War In Europe: Best Practices For Managing Market Volatility

Summary

Early Thursday, Russia invaded Ukraine. Explosions were reported across the country.

War creates market volatility, and this can be very stressful for investors. You may feel the urge to sell everything. Don't!

Historically, foreign wars have little sustained impact on stock markets or economic growth.

The key to making money is to buy low and sell high. History has proven selling in a market correction monetizes losses. A market correction could be your best opportunity to invest for the future.

In general, individuals should hold cash for emergency funds, saving for a house, or household costs. Large amounts of capital held in cash generally produce lower returns.

Stay diversified and disciplined to your investment frequency. "The trick is not to learn to trust your gut feelings, but rather discipline yourself to ignore them." - Peter Lynch.

Balance between sectors and styles, growth and value, defensive stocks, dividend-paying stocks to maximize rewards and minimize your risk.

Russian Forces Invade Ukraine

Market downturns can be overwhelming and scary as investors watch the price of their holdings fall - it can be tempting to sell or hit pause. Peter Lynch said, "The trick is not to learn to trust your gut feelings, but rather to discipline yourself to ignore them. Stand by your stocks as long as the fundamental story of the company hasn't changed.People who succeed in the stock market also accept periodic losses, setbacks, and unexpected occurrences." We're seeing a lot of panic in the markets that revolve around fears of a European war leading to an economic slowdown or global recession. This event, combined with the following concerns listed below, has led the market to correct severely since the beginning of the year.

Threat of Fed interest rate hikes

Inflation

Supply chain issues

Omicron

Slowing growth

War in Europe

While these issues may seem daunting, and a Fed rate increase may be inevitable, there's no need to liquidate your portfolio. Of course, if you live in Ukraine, it would be highly appropriate to take wartime measures. Ukraine’s economy and the welfare of its citizens are facing terrifying uncertainty. For the rest of the world, these problems and concerns cannot guarantee an economic downturn, a recession, or an extended bear market. LPL Research posted an interesting article on Mideast military escalations and their implications for markets. The article stated (quoting a a CFRA study): “We cannot dismiss the risk that the situation may escalate further into a broader conflict. However, from a markets perspective, we want to be careful not to overstate the potential impact.

History shows that stocks have largely shrugged off past geopolitical conflicts. We looked at significant geopolitical events dating back to 1990 and found that the Dow Jones Industrials Average has fallen an average of only 2% during 16 major geopolitical events, including the Gulf War, Iraq War, and 9/11. Over the subsequent three and six months, the Dow rose 88% of the time, with average gains of 5% and 7.9%, respectively. A review of 20 major geopolitical events dating all the way back to World War II showed stocks had fully recovered losses within an average of 47 trading days after an average maximum drawdown of 5%.”

Even if a systemic issue results in a severe downturn, it's still very difficult to time markets. Markets move up and down based on investor sentiment. For months, many investors have been selling securities based on the outlined fears and concerns. On Jan. 4, 2022, the S&P 500 and Dow hit all-time highs.

S&P 500 Hit All-Time High in January 2022

Since this period, stock market volatility has largely reflected uncertainty, and the market is experiencing extreme price fluctuations and heavy trading volume. The matters mentioned above create increased uncertainty and a disproportionate number of sellers. However, many of these issues can lead to market rotation. Sector rotation refers to taking money from one sector of the market and moving it to another in anticipation of demand for stocks in that sector. War, rising oil, inflation, and rising rates often can lead to a sell-off in overvalued growth stocks and an investment in stocks that fall in the energy or finance sector.

Many companies in sectors such as energy, finance, materials, and REITs,have strong earnings results during periods of inflation. Likewise, suppose your very valid concern is the market will continue to be volatile for an extended period. In that case, it pays to be diversified and in consumer staple stocks (food, beverages, and personal hygiene) or utility stocks(electric, gas, water, communication). It also helps to get paid while waiting for the dust to settle. Top Quant Dividend Stocks with safe dividends offer a buffer to the downside. Identify stocks characterized by sustainable growth, solid valuation frameworks, and robust profits. A correction or bear market can pose a period in history to invest with discipline and buy something you like at a deep discount or investments to minimize risk and maximize returns. In either scenario, the best investment strategy is to buy low and sell high, as well as, investing in companies where the fundamentals are strong. Based on the escalation of recent events, I am reissuing my five tips for navigating a volatile market.

5 Tips For Investing During a Turbulent Market

1. Stay Invested - Think Long Term

“Bargains are the holy grail of the true stock picker. We see the latest correction not as a disaster, but as an opportunity to acquire more shares at low prices. This is how great fortunes are made over time,” said Peter Lynch. Market volatility is usually temporary, and it typically pays to keep your money invested. The suspense of watching investments lose value, whether you're new or old to trading, is terrifying. Pulling that money out of the market is a risk that requires careful consideration because if you pull out, you risk locking in losses. If you purchase at a higher price point and sell after a price drop, you're selling for less than you paid. If the price rebounds, you haven't lost anything. The reason it's crucial to stay invested is that traditionally, the best days in the market follow the worst days, and it's impossible to time the market with precision and accuracy. It's essential to avoid the typical investor pitfall of capitulating during volatile times. "Investors crave control and may be tempted to act in a way that we know is likely to hurt their retirement strategy by selling out of the market after a significant loss, locking in those losses, but with every intention of reentering the market when it feels safer, whenever that may be," said Katherine Roy, JPMorgan Chief Retirement Strategist.

JPMorgan's Guide to Retirement (GTR) highlights "The impact of beingout of the market" and how behavior driven by loss aversion and trying to market time is one of the biggest detriments to portfolio returns. For perspective, the image below showcased how from Jan. 2, 2001, through Dec. 31, 2020, six of the seven best trading days occurred after the worst days.

If your favorite stocks are Alphabet (GOOG) (NASDAQ:GOOGL), Apple (AAPL), and Amazon (AMZN), they're all a heck of a lot cheaper than they were two months ago. Exiting the market because of fear may result in more significant losses or missing the best trading days in volatile markets. Stay invested and think long term.

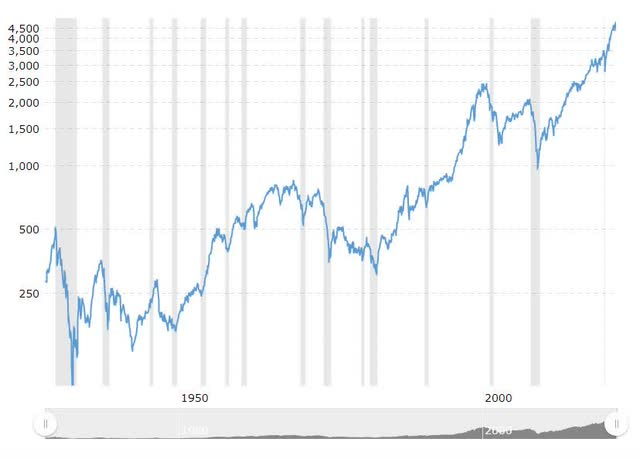

2. Put Your Money to Work Consistently (Dollar-Cost-Averaging) Rather Than Sitting in Cash

“If you invest $1,000 in a stock, all you can lose is $1,000, but you stand to gain $10,000 or even $50,000 over time if you’re patient,” said Peter Lynch. For a long-term investor, if you’re fortunate to have cash on the sidelines, market volatility presents great potential to buy securities at better valuations. Downturns are an effective way to improve the quality of your portfolio by increasing holdings to high(er) quality companies that may have been expensive, overstretched, or outside of your price point. Looking at the last correction, which took place in March of 2020 during the peak of COVID restrictions and lockdowns, you can see in the chart below that the market has more than doubled from its panic drawdown. With volatility, these companies may now be more attractive again and become undervalued with the opportunity to purchase and capitalize on future growth.

50-Years of the S&P 500: Buy Low, Sell High, Don’t Panic!

Over the long term, one of the best investment strategies to maximize returns and reduce risk is through dollar-cost averaging (DCA). DCA is the practice of systematically investing your cash over regular intervals, regardless of stock price. DCA is one of the most effective strategies for investors looking to smooth out the natural dips and rips in markets. DCA also helps to avoid the mistake of trying to time the markets. Regarding market timing, Charles Schwab research shows “that the cost of waiting for the perfect moment to invest typically exceeds the benefit of even perfect timing. And because timing the market perfectly is nearly impossible, the best strategy for most of us is not to try to market-time at all." Holding cash is essential for emergency funds or if you are about to retire or saving for a house. It's crucial to have money on the side if you need cash or annual household operating costs in the next few years. However, large amounts of capital held in cash generally produce lower returns.

If you’re holding cash as a means of loss aversion, you’re losing the opportunity for growth. Sitting on cash, especially in the current inflationary environment, is like throwing money away or lighting it on fire. If $100 that sat in cash last year is only worth $93 today given the 7% inflation, taking that forward, even if inflation moderates back to the Fed’s target of 2%, that moderation won’t happen overnight - it will most likely settle around the 3%-4% range. Even then, today’s $93 will be worth less than $90 over the next year because of the impact of inflation and loss of purchasing power associated with purely sitting in cash. “Today, people who hold cash equivalents feel comfortable. They shouldn’t. They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate in value”, said Warren Buffett.

3. Know What You Own

In the words of Peter Lynch, “Know what you own, and know why you own it.” This advice is straightforward and a no-brainer. If you cannot understand what a company does, why invest? Additionally, investing in friends’ projects or the latest meme stock because it’s trending may not be the best opportunity for you.

Fortunately, Seeking Alpha’s research, news, and quant grades can help you immediately understand your investments. Notably, the quant ratings and factor grades help to provide an instant characterization of your stock, ETF, or REIT’s strength compared to its peer group.

Ratings and Factor Grades Provide An Instant Score Of Strength or Weakness

The Internet and stock market are full of “tips” for getting rich quickly. Putting your money into investments simply out of fear of missing out - FOMO - without ever reading the fine print, or failing to understand the investment, can set you up for a rollercoaster ride. Stay true to your investment strategies and risk tolerance, staying the course to achieving your goals. Pick stocks that have strong fundamentals and will benefit you in the long run. A deep dive into a stock's valuation framework is just one click away.

4. Focus on Good Companies And Diversify

As the markets pull back, you may find success in identifying stocks with fair valuations that are at great price points and have taken a hit during market volatility. These securities can easily be found in our Top Stocks By Quant screen. Seeking Alpha Contributor and Strategist, Lawrence Fuller, believes a Midterm Correction Is Par For The Course. He states, “Provided there is no recession, this correction is presenting opportunities to invest in quality and value.” Paradoxically, even if you hold an opinion similar to Mike Wilson from Morgan Stanley, the market's biggest bear according to CNBC, who suggests investors are dangerously downplaying a collision between a tightening Fed and slowing growth. Largely, Mike Wilson believes the market could decline another 10% and that investors should double down on defensive stocks. As I mentioned previously, it pays to be diversified and own some of our consumer staple stocks (food, beverages, and personal hygiene) or utility stocks (electric, gas, water, communication). If you believe inflation is a key concern, you would want to inflation proof your portfolio with our energy or financial stocks. Again, it also helps to get paid while you wait for the dust to settle. Top Quant Dividend Stocks with safe dividends offer a buffer to the downside.

The key to long-term investing is finding high-quality stocks characterized by sustainable growth, solid valuation frameworks, robust profits, positive earnings revisions, and strong momentum compared to peers. As Buffett says, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price,” which is why I have included my Top 10 Stocks to buy in 2022, which highlights 10 high-quality companies that should do well in a correction or stock market rally.

You want companies with a strong track record of earnings growth and high earnings quality. In rising interest rate environments, Value Stockstend to be great investments as they tend to have strong balance sheets, especially after periods of relative underperformance. Conversely, Growth Stocks often take the greatest hit during a correction. Specific growth-oriented sectors can still insulate in high interest-rate and volatile environments if they possess solid fundamentals and underlying metrics.

In the long run, investing in high quality removes the need to market time Growth Vs. Value as your portfolio ultimately will be made up of both and should benefit in all market cycles relative to purely growth or purely value.

5. Find Resources and Tools to Educate Yourself

When people get scared, they tend to make emotional investing decisions, frequently trading during volatile periods. “You’ve got to be prepared when you buy a stock to have it go down 50% or more and be comfortable with it, as long as you’re comfortable with the holding,” says Buffett.

There are many stock market investment research and analysis sites with helpful information. Luckily, you found Seeking Alpha to make investing easy for you and for anyone interested in self-directed investments that have a chance to outperform the market. Seeking Alpha is the world’s largest investing community, powered by the wisdom and diversity of crowdsourcing, breaking news, contributor research analysis, Quant ratings and Factor grades, Dividend Ratings, and data visualizations. Likewise, for an instant characterization of stocks, our Quant Tools are an objective, unemotional evaluation of every stock, based upon data, company financials, the stock’s price performance, and analysts’ estimates of the company’s future revenue and earnings.

Conclusion

War and market volatility are very stressful for investors. Historically, foreign wars have had little sustained impact on stock markets or economic growth. If you feel the urge to sell everything. Don’t! The most important investment principal to making money is Buy Low and Sell High. A market correction could be the best way to invoke this strategy and invest for the future. History has proven selling in a market correction monetizes losses. Notably, individuals should hold cash for emergency funds, saving for a house, or household costs. Large amounts of capital held in cash generally produce lower returns. For long-term investors, it's important to stay diversified and disciplined to your investment frequency. Find a balance between sectors and styles, growth and value, defensive stocks and discretionary stocks, and dividend-paying stocks to maximize rewards and minimize your risk.

Exploring sites and utilizing tools so that you can make tactical investment decisions is an excellent step in navigating a volatile market without changing the overall risk level in your portfolio.